texas estate tax calculator

Tax Code Section 1113 b requires school districts to provide a 40000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value. School district taxesAll residence homestead owners are allowed a 25000.

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

. Original records may differ from the information on these pages. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Income tax calculator 2022 - Texas - salary after tax Property 3 days agoIf you make 55000 a year living in the region of Texas USA you will be taxed 9295That means that your net pay will be 45705 per year or 3809 per month.

Its referred to as a death tax by some. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in El Paso County. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

Starting in 2023 it will be a 12 fixed rate. The appraised value of your home is 250000. 1 The type of taxing unit determines which truth-in-taxation steps apply.

Hays County Tax Office makes no warranties or representations whatsoever regarding the quality content completeness accuracy or adequacy of such information and data. Tax Rate City ISD Special District Hospital College General Homestead Over 65 or Surviving Spouse Disabled Person Neither Disabled Veterans 10-29 Disabled Veterans 50-69 Disabled Veterans 30-49 Disabled Veterans 70-100 None. Although states in the United States may levy their estate taxes this calculator solely calculates federal estate taxes.

Suppose you live in Travis County where the average county tax rate is 18. A tax on the entire worth of a persons estate at the time of their death is known as an estate tax. Property taxes are one of the oldest forms of taxation.

The Lone Star State has a property tax rate of 183 which is. For comparison the median home value in Texas is 12580000. Texas estate tax calculator Thursday May 5 2022 The property tax in Texas applies to all real property and some tangible personal property in the state.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Tarrant County Property Tax Rates Photo credit. Hays County Tax Office reserves the right to make changes at any time without notice.

New York Property Tax Calculator 2020 Empire Center For Public Policy. The concept of estate in this calculator should not be mistaken. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Property 2 days ago Sales TaxesVehicles and ModificationsProperty Tax ExemptionsProperty Tax Exemption For Texas VeteransThere are several types of exemptions people with disabilities or individuals over 65 can be eligible for. The tax rate ranges from 116 to 12 for 2022. This is equal to the median property tax paid as a percentage of the median home value in your county.

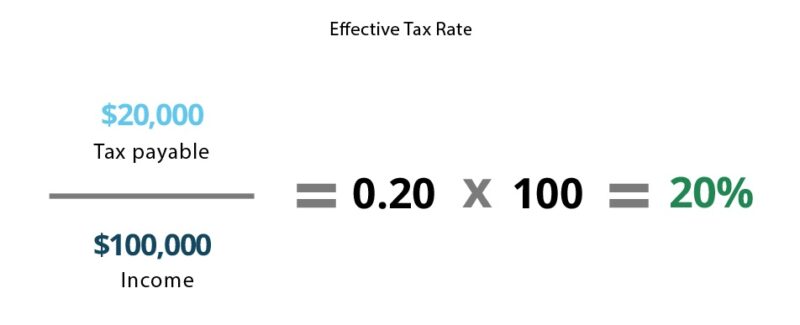

Your information will be updated regularly during. The estate tax rate is based on the value of the decedents entire taxable estate. Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Based on the average tax percentage your property tax for the year will be around 4550. Factors Affecting Property Taxes in Texas.

The median property tax on a 10180000 house is 184258 in Texas. Paladin Tax Consultants helps you in Appeal and Protest against unfair property tax assessment and increase. Skip to content 1 210 776 1833.

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. The median property tax on a 10180000 house is 106890 in the United States. Texas property tax rates are among the highest in the United States.

The local option exemption cannot be less than 5000. Tax Exemptions Office of the Texas Governor Greg Abbott. Take a look at the table below.

Calculate your property tax with our online property tax calculator. Lets explain the property tax process with an example. If you make 55000 a year living in the region of Texas USA you will be taxed 9295.

In fact the earliest known record of property taxes dates back to the 6th century BC. County and School Equalization 2022 Est. The property tax is used to finance the States 254 counties over 1200 cities 1022 independent school districts and more than 1800 special districts.

Thankfully there is no inheritance tax in Connecticut. Generally all real estateland and buildingswhether owned by an individual or. The 2017 Tax Cuts and Jobs Act doubled the exemption amount which was originally 5590000 for 2017.

Estate tax calculation For 2022 the estate exemption is 12060000 with a top federal estate tax rate of 40 Rev. Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Estate and gift taxes the congressional budget office noted raised only about 14 billion in federal revenue in. In our calculator we take your home value and multiply that by your countys effective property tax rate. The property tax in Texas applies to all real property and some tangible personal property in the state.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Property Tax How To Calculate Local Considerations

Property Tax Calculator Casaplorer

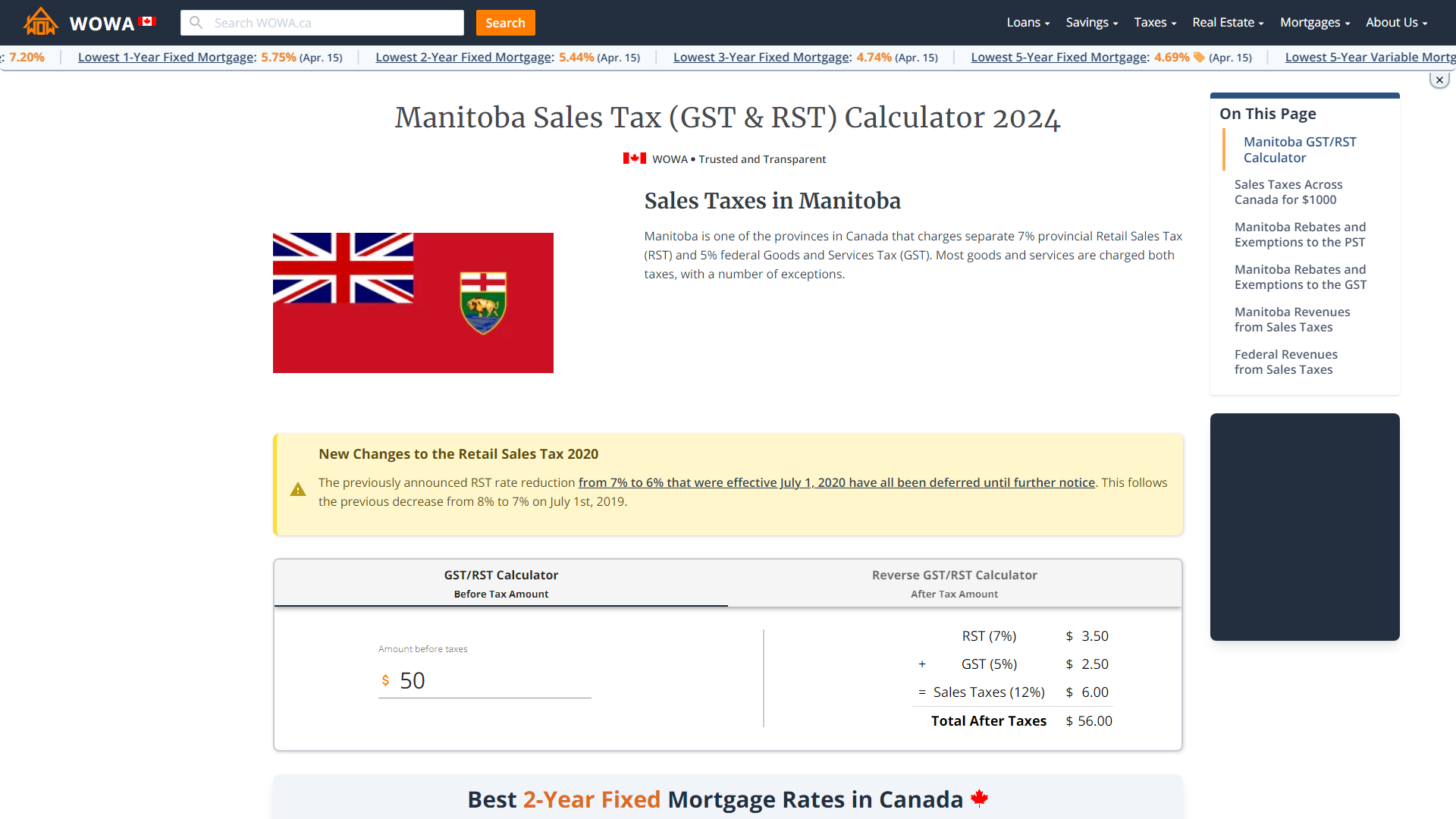

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Capital Gain Tax Calculator 2022 2021

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

What Are Marriage Penalties And Bonuses Tax Policy Center

Marginal Tax Rate Formula Definition Investinganswers

State Corporate Income Tax Rates And Brackets Tax Foundation

Income Tax Calculator 2021 2022 Estimate Return Refund

How To Calculate Net Operating Loss A Step By Step Guide

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes Estate Planning Estate Planning Attorney Estate Tax

Texas Income Tax Calculator Smartasset

Income Tax Calculator Estimate Your Refund In Seconds For Free

New York Property Tax Calculator 2020 Empire Center For Public Policy